In the ever-evolving landscape of investment management, the words of Li Wenbin, Co-General Manager of the Equity Investment Department at Yongying Fund, offer a lens through which aspiring and experienced fund managers alike can evaluate their approachesWhen interviewed by Securities Times, Li emphasized a critical understanding: fund managers must continuously expand their capability circles to achieve substantial returnsDrawing on his extensive experience and successes, he has not only navigated the complexities of the financial market for over 14 years but also managed investments totaling over 100 billion yuan.

Li's recognition as a "learning-oriented fund manager" stems from his steadfast commitment to ongoing education and self-improvementBy consistently adapting his investment strategies and understanding market trends, he has effectively met the challenges presented by dynamic economic conditions

After joining Yongying Fund in early 2024, he remains optimistic about the future of the A-shares market, suggesting that we are at the inception of a comprehensive market recovery processHe identifies two key areas for potential investment: debt relief-related opportunities and industries associated with new productivity.

Throughout his career, Li has stressed the importance of acquiring new knowledge and challenging prevailing assumptionsTransitioning from an industrial background to the financial sector, he recognizes the necessity of building a robust understanding of underlying technologies, particularly in the realm of hard technology investmentsHis insights highlight that investment decisions should never rest on grand narratives without a solid grasp of the underlying principles at play, urging a cautious approach to valuations.

In his experiences, Li has witnessed numerous companies riding on the coattails of dominant narratives only to suffer declines when the expected growth fails to materialize

- Dollar/Yen Hits Five-Month High

- Slight Decline in the Dollar Index

- AI Revolutionizes Home Decoration

- Dollar Retreats, Oil Prices Rebound

- The Secret Behind Visual China's Stock Surge

For him, being an exceptional fund manager hinges on the ability to project a company's growth trajectory over the next two to three years, necessitating a commitment to ongoing research and review.

Moreover, a critical aspect of Li's investment philosophy involves maintaining a discerning mindsetHis industry experience arms him with a rational perspective regarding business assessmentsWhen engaging with publicly available information, he adopts a skeptical approach, well aware that the practical implementation of promises often requires time to realizeThis perspective extends to his interactions with listed companies, treating their optimistic forecasts with caution while conducting comprehensive evaluations before arriving at investment decisions.

Li exhibits versatility in his investment choices, skillfully navigating industry trends to realign his portfolioHis strategic adjustments over the years—such as increasing allocations to the livestock sector in Q3 of 2018, semiconductor stocks in Q2 of 2019, pharmaceuticals in Q1 of 2020, and the new energy vehicle supply chain in Q4 of 2020—reflect his adaptability and insight into market movements.

Proficient in identifying alpha opportunities even in beta-less climates, Li presents a unique challenge to fund managers

He notes that selecting sound companies within thriving industries is often straightforward; however, the ability to uncover promising firms during sluggish industry performances rigorously tests a manager's stock-picking and investment acumen.

Li's investment style currently leans toward dynamic balanced allocation, targeting stable operations and high-quality growth assetsThis shift results from an evolution of his investment philosophy, which has matured through recent developments in the investment landscapeHis goal is to solidify the returns for investors in a manner that reflects genuine asset performance.

In discussing these focal asset categories, Li articulates distinct criteria to identify companies suitable for investmentFor stable operational assets, he identifies four critical factors: 1) the organization's resilience against macroeconomic shifts, remaining unaffected by global trade policies for a foreseeable 3 to 5 years; 2) a commitment to shareholder value and social responsibility, void of potential risks related to taxation or environmental concerns; 3) prudent fiscal management, ensuring ample free cash flow, and gradually lowering debt; and 4) a focus on core operations without unnecessary expansion of business lines.

On the other hand, assessing high-quality growth assets involves three pivotal questions: Is the growth genuine or a façade? What is the extent of the anticipated growth? And how reliable is the growth in terms of quality and certainty? Addressing these inquiries guides managers in distinguishing between companies that exhibit real potential versus those that may merely capitalize on transient market trends.

In light of current conditions, Li welcomes a positive outlook for the A-share market

He perceives the present moment as the incipient phase of a recovery rather than a mere rebound, asserting that significant market upswings often emerge in conjunction with economic shifts and policy reformsAs such, his philosophy drives focus toward investment opportunities within debt remediation and industries aligned with emerging productivity.

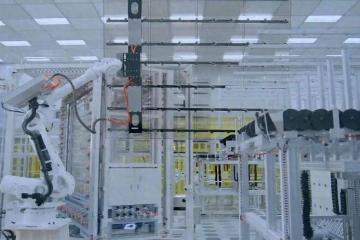

Specific attention is warranted in sectors such as renewable energy, specifically companies engaged in hydraulic, nuclear, and gas operations, along with strong players within the tech industry like semiconductors and artificial intelligenceFurthermore, growth in industrial metals due to supply adjustments and the rise of overseas brands navigating global markets represent areas of strategic investment, in addition to innovations in sectors like low-altitude economy venturesAs Li sees it, 2024 may not just signify another year in public fund management but a true renaissance for the industry.

The anticipated expansion of ETF products, primarily centered around core indices like the CSI 300 and the CSCI A500, will likely play a critical role in normalizing irrational market fluctuations and ensuring a foundational commitment to risk-adjusted returns